Interested? Contact us now

In order to contact us please fill the form on the right or directly email us at the address below

sales@senecaesg.com

As investors increasingly look beyond financial performance to assess long-term sustainability, ESG scores have become a crucial tool for evaluating companies’ environmental, social, and governance practices. In fact, according to a study by PwC, 79% of investors believe ESG risks are an important factor in investment decision-making [1], and the global ESG assets are projected to reach $53 trillion by 2025 [2]. This growing prevalence shows that ESG scores are no longer just a “nice-to-have” metric, but a crucial tool in assessing long-term value and risks.

To help you better understand what ESG scores are, what they measure, and the challenges in accurately evaluating them, this article provides a clear breakdown of the basics.

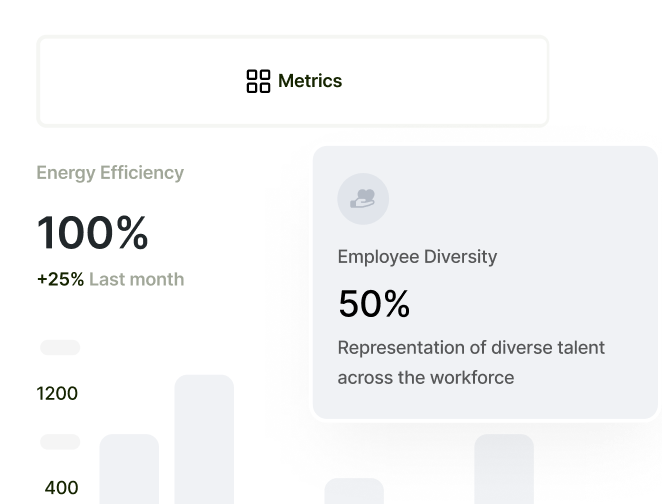

ESG scores are numerical ratings that evaluate a company’s performance across three critical areas: Environmental, Social, and Governance. These scores offer a comprehensive view of how well a company manages risks and opportunities related to sustainability and ethical practices. Environmental aspects include factors like carbon footprint and energy efficiency, social aspects cover issues such as labor practices and community engagement, and governance examines elements like board diversity and executive pay. ESG scores help investors and stakeholders gauge a company’s commitment to sustainability and responsible business practices.

ESG scores offer crucial insights into a company’s management of environmental, social, and governance risks and opportunities, helping investors gauge its sustainability and ethical practices. Research has shown that companies with high ESG scores often exhibit stronger financial performance and lower risk profiles. For instance, a 2021 study by Morgan Stanley revealed that companies with high ESG scores outperformed their peers, with those in the top quintile generating a 3.6% higher annual return compared to those in the bottom quintile.

Moreover, a report by MSCI found that firms with higher ESG ratings experienced less volatility and were more resilient during market downturns, with a 50% lower risk of bankruptcy over a 10-year period. These scores also enable investors to align their portfolios with their values, as 79% of institutional investors consider ESG factors when making investment decisions, according to a 2020 survey by PwC.

ESG scores help investors not only in identifying companies that are better positioned for long-term growth but also in managing strategic risks and capitalizing on emerging opportunities in sustainable industries. By integrating ESG scores into their decision-making processes, investors can make more informed choices, potentially enhancing both financial returns and alignment with their ethical standards.

ESG scores assess various environmental factors to gauge a company’s sustainability practices and impact. Key aspects include:

These environmental factors are critical for long-term business sustainability as they help companies reduce their ecological footprint, lower costs, and avoid regulatory fines.

Social factors in ESG scores focus on a company’s relationships with its employees, customers, and communities. Key areas include:

Social responsibility is increasingly integral to modern corporate strategies as it enhances brand reputation and builds stronger stakeholder relationships.

Governance factors in ESG scores evaluate how well a company is managed and whether it adheres to ethical standards. Key elements include:

Effective corporate governance is fundamental to maintaining business ethics, integrity, and long-term shareholder value. [3]

Several prominent ESG rating systems and providers offer valuable insights into companies’ sustainability and ethical practices. These ratings help investors and stakeholders make informed decisions by evaluating companies across various ESG criteria. Here are some well-known ESG rating providers:

MSCI ESG Ratings are designed to evaluate a company’s resilience to long-term ESG risks and opportunities. MSCI uses a combination of industry-specific and general ESG factors to assess a company’s overall ESG performance. The ratings range from ‘AAA’ (excellent) to ‘CCC’ (poor), reflecting how well a company manages its ESG-related risks compared to its peers. [4]

Key Features of MSCI ESG Ratings:

MSCI’s ratings are a key tool for investors seeking to align their portfolios with ESG principles and make informed decisions based on comprehensive sustainability assessments.

Despite the growing importance of ESG scores, several challenges can complicate their effectiveness. One major issue is the variability in ESG rating methodologies among different rating agencies. Each provider uses distinct criteria and weightings, which can lead to inconsistent scores and make comparisons difficult.

Additionally, there is a lack of standardized global frameworks for ESG reporting. Without a unified set of guidelines, companies may report ESG metrics in varied formats, making it challenging for investors to interpret and compare data effectively.

Data quality and transparency also pose significant problems. Companies often struggle with the accuracy and completeness of their ESG disclosures, and inconsistent reporting practices can undermine the reliability of ESG scores.

To navigate these challenges, companies can adopt best practices for ESG reporting, such as following internationally recognized frameworks like the Global Reporting Initiative (GRI) or the Sustainability Accounting Standards Board (SASB). Implementing robust data management systems and engaging in third-party audits can also enhance transparency and accuracy. By addressing these issues, companies can improve their ESG scores and provide more reliable information to investors.

ESG scores are crucial for assessing a company’s sustainability and ethical practices, guiding investors in making informed decisions. However, challenges such as varying methodologies, lack of standardization, and data quality issues can complicate their effectiveness. By understanding these challenges and adopting best practices, companies can enhance their ESG reporting and scores.

Seneca ESG helps with ESG reporting

For tailored assistance with improving your ESG performance and navigating the complexities of ESG reporting, Seneca ESG offers expertise and solutions that could help streamline your ESG strategy and enhance your scores. Reach out to us to explore how we can support your ESG goals.

Sources:

[1] https://www.pwc.com/vn/en/media/press-release/211105-esg-investors-en.pdf

[4] https://www.apiday.com/blog-posts/what-are-the-msci-esg-ratings

[5] https://wp.senecaesg.com/insights/what-are-esg-scores-and-why-do-they-matter/

Monitor ESG performance in portfolios, create your own ESG frameworks, and make better informed business decisions.

In order to contact us please fill the form on the right or directly email us at the address below

sales@senecaesg.com7 Straits View, Marina One East Tower, #05-01, Singapore 018936

+(65) 6223 8888

Carrer de la Tapineria, 10

Ciutat Vella, 08002, Barcelona, Spain

+34 612 22 79 06

77 Dunhua South Road, 7F Section 2, Da'an District Taipei City, Taiwan 106414

(+886) 02 2706 2108

Av. Santo Toribio 143,

San Isidro, Lima, Peru, 15073

(+51) 951 722 377