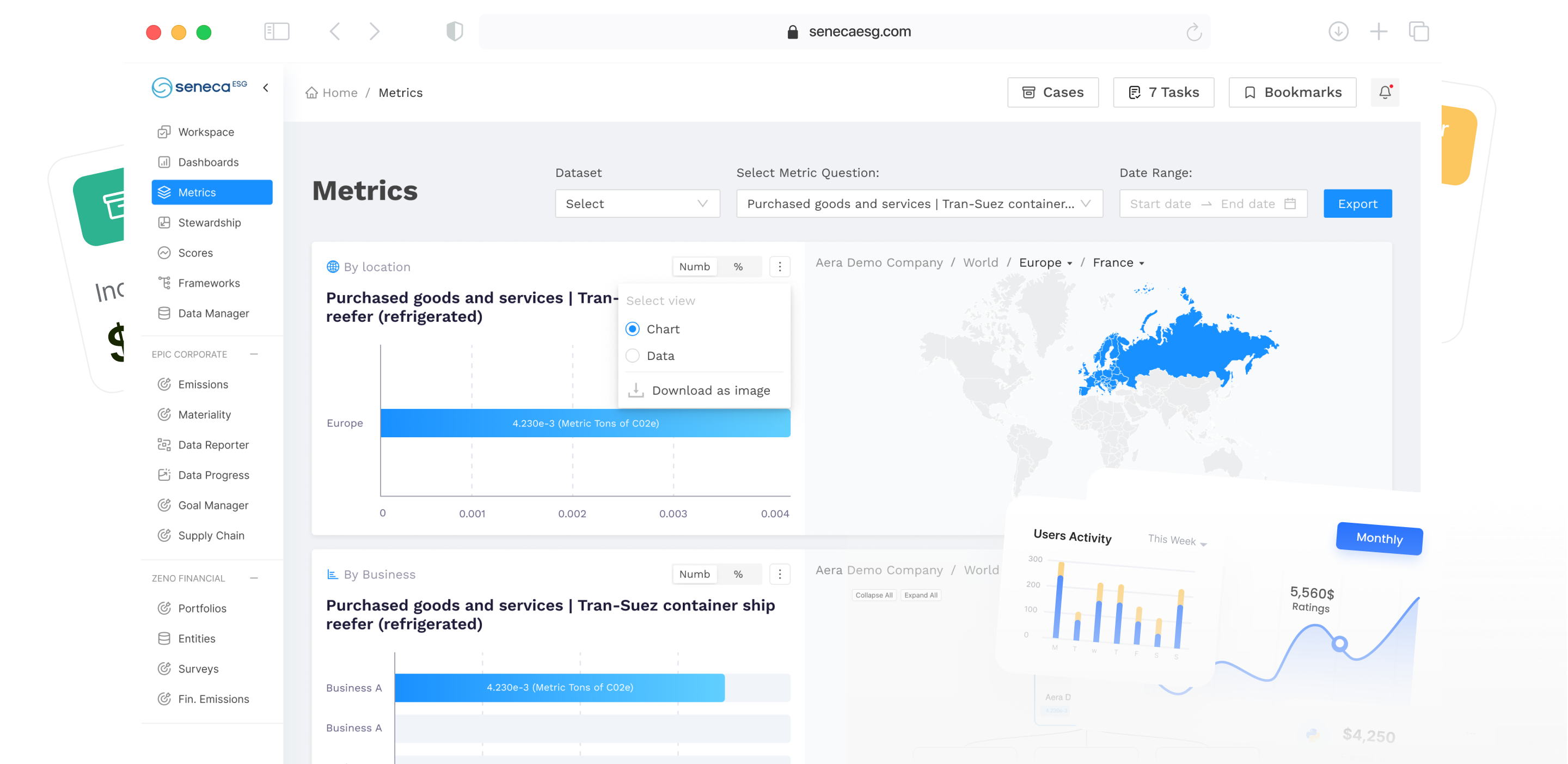

All-in-one

platform for enterprise

sustainability

platform for enterprise

sustainability

Collect data, align your team and get audit-ready with the leading sustainability management platform for mid-market companies.

Used by the world's leading companies

80+

ESG Frameworks Supported

20+

Supported ESG Datasets

1M+

Data Entries Processed

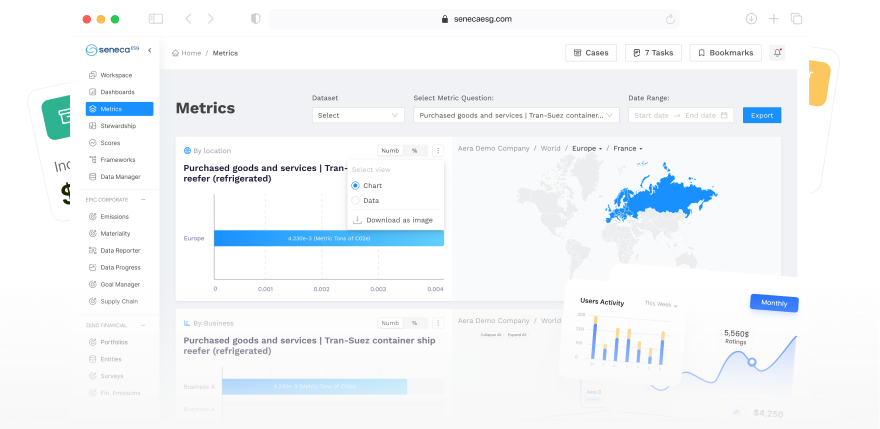

Trusted sustainability and ESG insights from one reliable source

Collect

Seamlessly collect and organize ESG data from all parts of your business, all in one place.

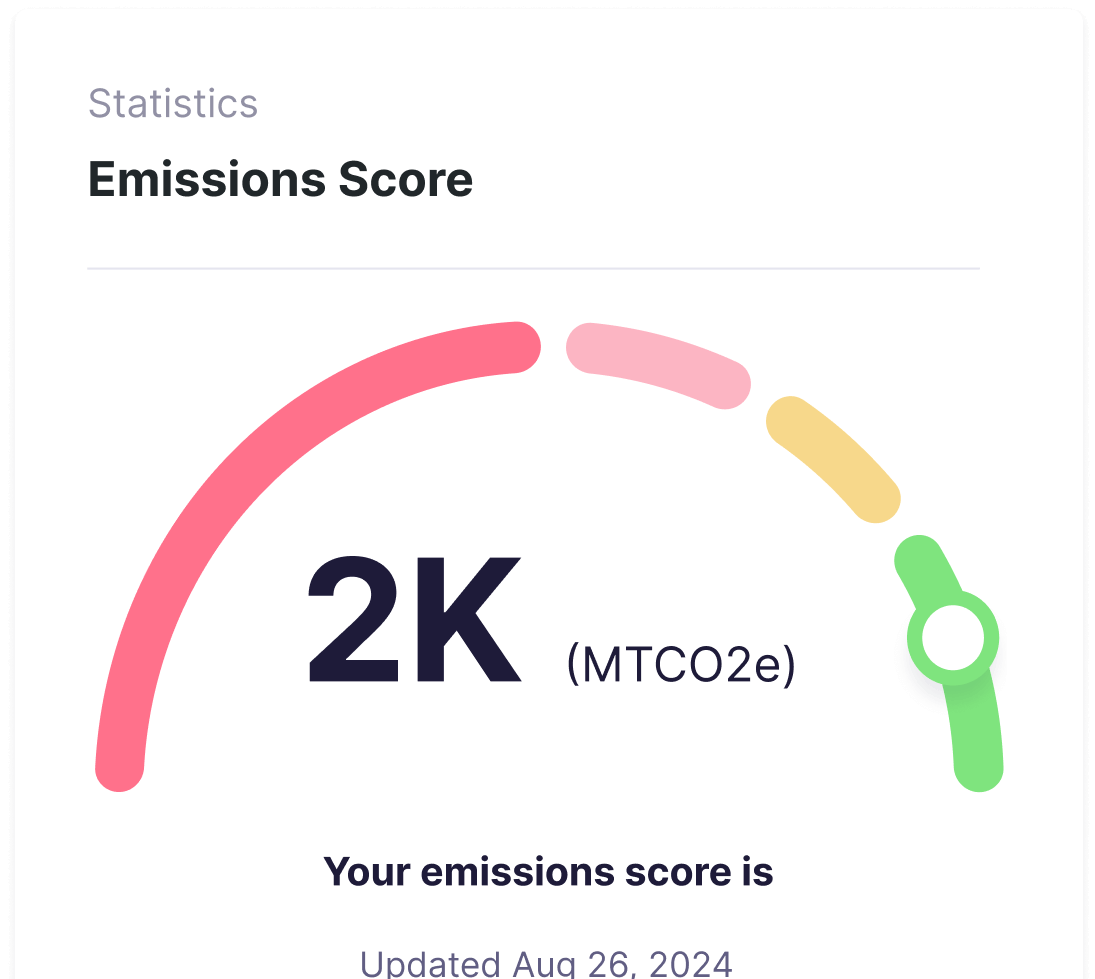

Measure

Calculate your carbon footprint across scopes 1, 2, and 3.

Report

Prepare and file investor-grade, audit-ready disclosures to meet regulator and stakeholder requirements.

Analyze

Identify and prioritize ESG risks and opportunities.

Why do the

world's leading

companies choose

SenecaESG?

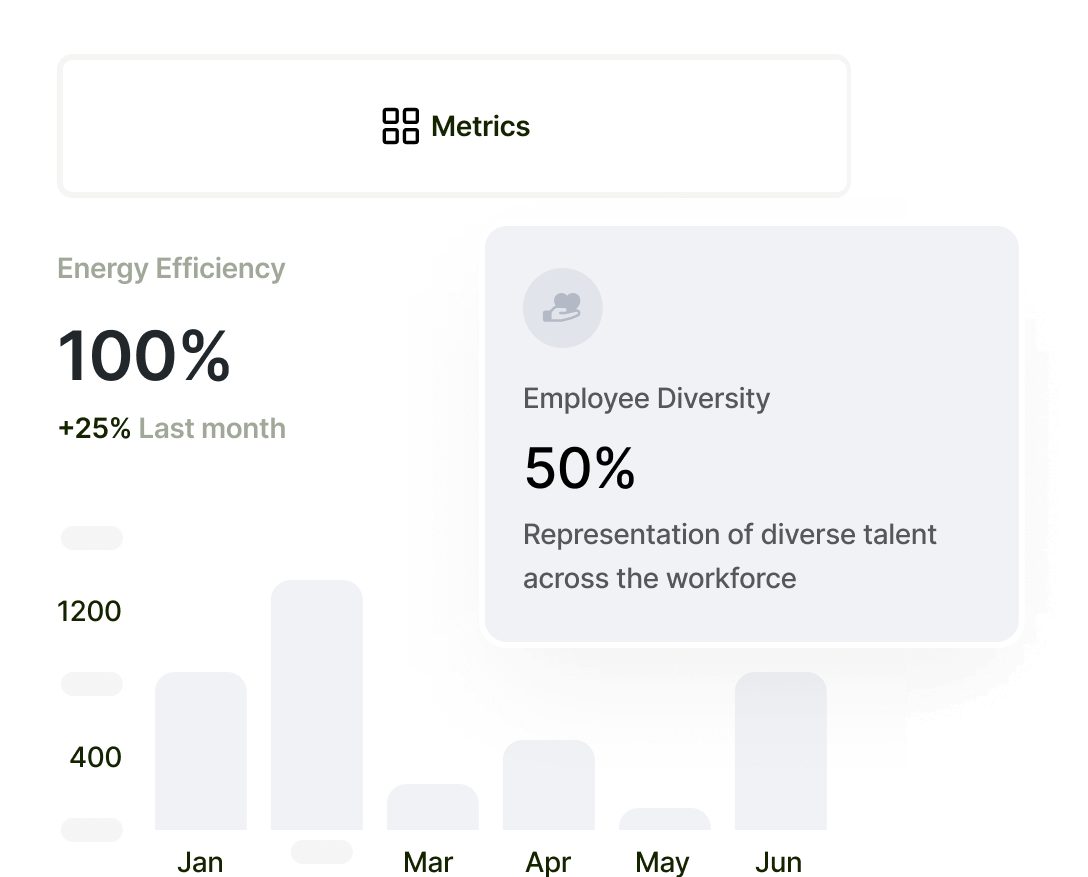

The only all-in-one platform

Purpose-built software

Flexible and future-proof

Why do the

world's leading

companies choose

SenecaESG?