ご興味がありますか?今すぐご連絡を

ご連絡の際は右のフォームをご記入いただくか、下記メールアドレスまで直接ご連絡ください。

sales@senecaesg.com

Hong Kong has taken a major step in both green and digital finance with the launch of a US$1.2 billion, or HK$10 billion, multi-currency digital green bond package, the largest sovereign-backed digital bond issuance in global markets so far.

Issued by the Hong Kong SAR Government, the bonds are spread across four currencies and a range of maturities: HKD2.5 billion in two-year notes, RMB2.5 billion in five-year notes, US$300 million in three-year notes, and €300 million in four-year notes. Investor interest was extremely strong, with demand more than ten times the available supply and total orders exceeding HK$130 billion, drawing in insurers, pension funds, global asset managers, banks, and private wealth platforms, including many first-time buyers of digital bonds.

What makes this deal truly groundbreaking is the settlement layer. For the HKD and RMB tranches, investors were able to settle using tokenized central bank money, e-HKD and e-CNY, marking the first time tokenized central bank currencies have been embedded directly into the primary settlement of a sovereign digital bond. This helped shorten settlement times, reduce counterparty risk, and cut operational costs, while serving as a live test case for future cross-border liquidity arrangements between central banks.

The issuance also upgrades market plumbing. Each bond carries a Digital Token Identifier (DTI) aligned with ISO 24165 and linked to its ISIN and the government’s Legal Entity Identifier. Combined with expanded use of the International Capital Market Association’s bond data taxonomy, this enhances traceability and supports automated compliance checks: key for institutional investors who need robust data standards before integrating tokenized assets into mainstream portfolios.

Crucially, the government is positioning this not as a one-off experiment but as part of a long-term strategy. Officials have signaled that digital bonds will become a permanent financing tool under Hong Kong’s broader sustainable bond program, tying together its ambitions as both a leading green finance hub and a pioneer in digital capital markets.

Globally, the transaction offers a concrete blueprint for how sovereign issuers can combine green use-of-proceeds frameworks, tokenized securities, and central bank digital money, pointing toward a future where digital market infrastructure underpins large-scale climate finance.

ソース

https://esgnews.com/hong-kong-issues-1-2-billion-digital-green-bond-package/

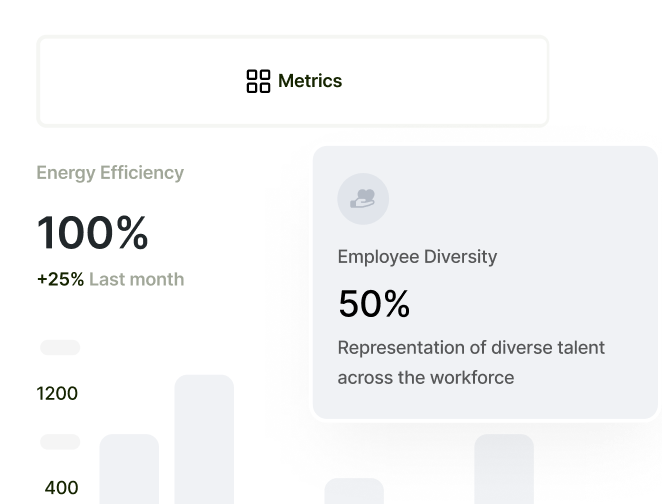

ポートフォリオのESGパフォーマンスを監視し、独自のESGフレームワークを作成、より良い意思決定をサポートします。

ご連絡の際は右のフォームをご記入いただくか、下記メールアドレスまで直接ご連絡ください。

sales@senecaesg.com7 Straits View, Marina One East Tower, #05-01, Singapore 018936

+(65) 6223 8888

Gustav Mahlerplein 2 Amsterdam, Netherlands 1082 MA

(+31) 6 4817 3634

77 Dunhua South Road, 7F Section 2, Da'an District Taipei City, Taiwan 106414

(+886) 02 2706 2108

Viet Tower 1, Thai Ha, Dong Da Hanoi, Vietnam 100000

(+84) 936 075 490

Av. Santo Toribio 143,

San Isidro, Lima, Peru, 15073

(+51) 951 722 377

1-4-20 Nishikicho, Tachikawa City, Tokyo 190-0022