有興趣?立即聯絡我們

請填寫右側表單,或直接郵件聯絡我們:

sales@senecaesg.com

The shift in investor behavior regarding climate and social reforms has sparked new discussions about the future of corporate sustainability in the U.S. Amid growing regulatory uncertainty and rising political opposition to ESG initiatives, U.S. investors are scaling back their support for corporate climate action and social responsibility efforts, reflecting broader concerns about market risks and regulatory burdens.

Effective immediately, many institutional investors are reassessing their engagement with companies on climate and social governance issues, driven by the evolving political landscape and increased pressure to prioritize short-term financial returns. As regulatory challenges to ESG regulations rise, businesses may find themselves navigating less pressure to adhere to stringent climate and social reform policies.

Key Investor Trends and Regulatory Shifts:

These changes in investor behavior come at a time when the broader push for ESG regulations is facing significant challenges. As investors reduce their involvement in promoting corporate climate action and social reforms, businesses will need to navigate an evolving landscape where ESG factors are increasingly being sidelined. In this shifting environment, the role of corporate sustainability in long-term strategies may become more uncertain, and companies will need to find new ways to balance investor expectations with growing demands for climate and social responsibility.

The scaling back of U.S. investors’ support for climate and social reforms signals a major shift in the ESG landscape. As the regulatory and economic environment evolves, businesses will face new challenges in meeting sustainability goals, and it will be essential to navigate these changes carefully to maintain progress on climate action and social justice. Without sustained investor engagement, the ability to drive long-term ESG change may be hindered, potentially slowing efforts to address global climate change and inequality.

资料来源:

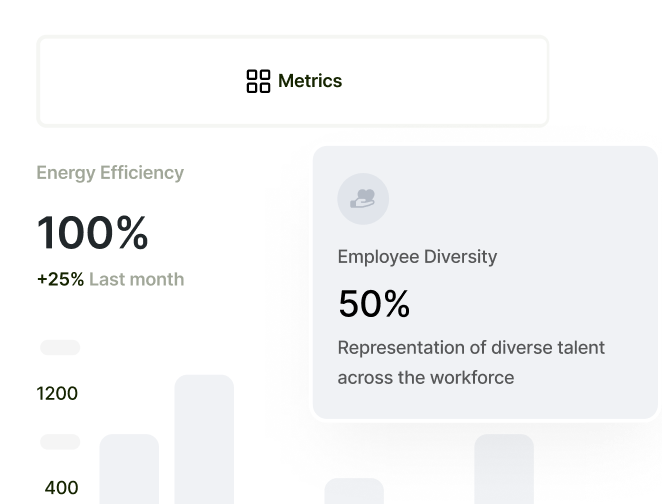

監控投資組合 ESG 表現,自建 ESG 框架,讓商業決策更精準。

請填寫右側表單,或直接郵件聯絡我們:

sales@senecaesg.com7 Straits View, Marina One East Tower, #05-01, Singapore 018936

+(65) 6223 8888

Gustav Mahlerplein 2 Amsterdam, Netherlands 1082 MA

(+31) 6 4817 3634

台灣台北市大安區敦化南路二段77號7樓,106414

(+886) 02 2706 2108

Viet Tower 1, Thai Ha, Dong Da Hanoi, Vietnam 100000

(+84) 936 075 490

Av. Santo Toribio 143,

San Isidro, Lima, Peru, 15073

(+51) 951 722 377

1-4-20 Nishikicho, Tachikawa City, Tokyo 190-0022