有興趣?立即聯絡我們

請填寫右側表單,或直接郵件聯絡我們:

sales@senecaesg.com

In 2025, environmental, social, and governance (ESG) performance is no longer a nice-to-have—it’s a business imperative. With growing regulatory pressure, investor scrutiny, and stakeholder expectations, the question is not whether to measure ESG, but how do companies measure their ESG performance effectively?

According to PwC’s 2024 Global Investor Survey, 76% of investors say that companies’ ESG performance plays a significant role in their investment decisions. [1] Moreover, regulators such as the EU (through CSRD) and the U.S. SEC are requiring ESG disclosures to be not only transparent but auditable. This makes robust ESG measurement frameworks more crucial than ever.

Before exploring how companies measure ESG performance, it’s essential to understand what’s being measured:

These ESG components vary across industries, which is why sector-specific benchmarks, like those from SASB or GRI, are often used.

One of the first steps in ESG performance measurement is selecting a framework. The most widely adopted ESG reporting frameworks include:

Many companies use a hybrid approach. According to OECD (2025), about 60% of companies reporting on sustainability use GRI, 54% comply with TCFD standards, and 37% adopt SASB—showing widespread alignment across multiple ESG frameworks. [2]

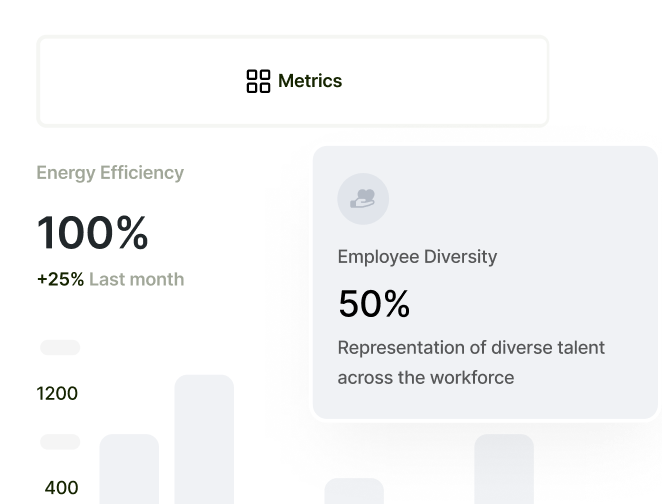

Companies then define Key Performance Indicators (KPIs) tailored to their operations and material risks. These may include:

| ESG Dimension | Example Metrics |

| 环境 | Scope 1–3 emissions, energy intensity, waste diversion rate, water usage |

| 社会 | Employee turnover, gender pay gap, training hours per employee, supplier audits |

| 管理 | Board independence, whistleblower reports, ESG oversight at board level |

Best practice in 2025 also includes science-based targets (e.g., SBTi-aligned GHG targets) and tracking 范畴 3 排放—which account for over 70% of a company’s carbon footprint.

Collecting reliable ESG data is among the most complex yet vital tasks. Those platforms will enable automated data collection from across departments, ensure audit trails, and support real-time ESG dashboards. According to Gartner (2025), 80% of large firms now use ESG platforms to consolidate and validate non-financial data. [3] 立即聯絡我們 並了解我們的創新工具如何為永續的未來鋪平道路。

Once ESG data is collected, companies benchmark their performance using:

ESG ratings influence investment, reputation, and creditworthiness. According to MSCI’s 2024 analysis, companies with higher ESG ratings consistently secure capital more cheaply—paying lower interest on debt and lower required returns on equity—demonstrating a clear financial benefit from strong sustainability performance. [4]

As ESG reports face increased regulatory scrutiny, companies are prioritizing third-party assurance. In 2025, the EU’s CSRD mandates limited assurance on ESG disclosures—expected to evolve to reasonable assurance by 2028.

Public reporting must align with recognized standards and include:

Companies like Nestlé, Apple, and BlackRock now publish integrated annual reports, combining financial and ESG data in a unified format.

联合利华

Unilever applies SASB and GRI frameworks to track over 90 ESG KPIs, from water stress to fair wage coverage. It uses TCFD-aligned scenario analysis to assess climate risk and publishes ISSB-ready disclosures. [5]

微软

Microsoft employs a proprietary ESG dashboard to monitor emissions, DEI metrics, and governance oversight. It charges internal carbon fees to business units, incentivizing low-carbon decision-making. [6]

Siemens

Siemens integrates ESG metrics into its enterprise risk management and ties executive compensation to ESG KPIs, including energy efficiency and safety records. [7]

| Action | 描述 |

| Define Materiality | Use double or financial materiality to focus metrics. |

| Select Frameworks | Align with ISSB, SASB, TCFD, GRI as needed. |

| Use ESG Platforms | Automate and centralize data tracking. |

| Integrate Reporting | Combine ESG and financial reports where possible. |

| Engage Auditors | Prepare for assurance-ready ESG reporting. |

Companies must treat ESG measurement as a strategic pillar, not a compliance task.

So, how do companies measure their ESG performance in 2025? They begin with the right frameworks, establish tailored KPIs, embrace digital tools, ensure transparency, and continually benchmark performance.

In today’s climate-conscious market, measuring ESG is more than accountability—it’s about resilience, reputation, and revenue. As investor expectations evolve, companies that lead with credible, data-backed ESG measurement will gain a lasting competitive advantage.

Now is the time to invest in ESG intelligence—because what gets measured, gets managed.

参考资料

[1] https://www.pwc.com/gx/en/issues/c-suite-insights/ceo-survey.html#global-investor-survey

[4] https://www.msci.com/documents/10199/6c2115f3-5fef-b883-278d-853de6ffc019

監控投資組合 ESG 表現,自建 ESG 框架,讓商業決策更精準。

請填寫右側表單,或直接郵件聯絡我們:

sales@senecaesg.com7 Straits View, Marina One East Tower, #05-01, Singapore 018936

+(65) 6223 8888

Carrer de la Tapineria, 10

Ciutat Vella, 08002, Barcelona, Spain

+34 612 22 79 06

台灣台北市大安區敦化南路二段77號7樓,106414

(+886) 02 2706 2108

Av. Santo Toribio 143,

San Isidro, Lima, Peru, 15073

(+51) 951 722 377