感兴趣?立即联系我们

请填写右侧表单或直接通过以下邮箱与我们联系

sales@senecaesg.comIn today’s fast-evolving regulatory landscape, regulatory reporting is no longer a back-office obligation but a central pillar of corporate governance and transparency. From financial disclosures to sustainability metrics, the pressure […]

In today’s fast-evolving regulatory landscape, regulatory reporting is no longer a back-office obligation but a central pillar of corporate governance and transparency. From financial disclosures to sustainability metrics, the pressure to comply with complex regulatory reporting requirements has intensified in 2025. Businesses that treat compliance as a strategic asset—rather than a cost center—are gaining a competitive edge.

Driven by global standards, digitization, and ESG expectations, regulatory reporting spans across industries and jurisdictions. According to PwC’s Pulse Survey: Executive Takes on Election 2024, 74% of Consumer Markets leaders agree that the outcome of the election could significantly impact how they conduct business [1]. This article explores the key types of regulatory reporting, compliance best practices, and ESG integration to help organizations navigate this critical area.

Regulatory reporting refers to the submission of required data and information to regulatory authorities to demonstrate compliance with laws, standards, and supervisory expectations. These reports are typically periodic and include financial, operational, risk, or sustainability disclosures.

While regulatory reporting compliance used to focus primarily on financial statements, today’s scope has expanded. Modern reporting includes:

Failure to meet regulatory reporting requirements can result in fines, reputational damage, and loss of market access. Therefore, a proactive compliance strategy is essential.

"(《世界人权宣言》) types of regulatory reporting vary by region, industry, and company size. However, they generally fall into the following categories:

| Reporting Type | 目的 |

| Financial Reporting | Ensure transparency of financial position and risk (e.g., GAAP, IFRS) |

| Prudential Reporting | Monitor capital adequacy, liquidity, and solvency (e.g., Basel III, Solvency II) |

| ESG and Sustainability | Disclose non-financial metrics and climate risk (e.g., CSRD, ISSB, TCFD) |

| Operational Risk Reporting | Manage and disclose internal risk and compliance controls |

| Tax and Regulatory Filings | Ensure tax compliance and jurisdictional reporting (e.g., FATCA, CRS) |

| Cybersecurity/Data Privacy | Report breaches and data handling processes (e.g., GDPR, NIS2 Directive) |

Increasingly, regulators expect data consistency across all these reports, reinforcing the need for integrated, accurate, and auditable systems.

Achieving regulatory reporting compliance in 2025 means confronting several persistent challenges:

Solutions include:

According to Deloitte, sales of ESG reporting software are projected to exceed $1 billion in 2024, reflecting a major shift toward digital compliance and reporting solutions fueled by rising regulatory pressures and investor expectations [2].

To illustrate the diversity and global nature of modern regulatory frameworks, here are some recent regulatory reporting examples from leading jurisdictions:

These examples show how regulatory reporting requirements are no longer siloed by geography or industry—they’re interconnected, transparent, and enforceable.

In 2025, regulatory reporting compliance is deeply intertwined with ESG. Investors, customers, and regulators alike expect consistent, comparable, and forward-looking non-financial disclosures.

Key ESG reporting trends include:

Companies that embed ESG data into their core reporting workflows gain strategic advantages. According to PwC’s 2024 Global Investor Survey, 71% of investors believe companies should embed ESG and sustainability directly into their corporate strategy, highlighting the growing weight of ESG factors in investment decision-making [3].

To future-proof your regulatory reporting approach, consider the following steps:

By transforming compliance from a defensive necessity into a strategic capability, companies not only mitigate risk but also create long-term stakeholder value.

Reducing environmental impact requires both individual action and innovative business solutions. We believe that lessening emissions doesn’t have to be complicated. With the right tools and insights, companies can make sustainability both achievable and actionable. That’s why we’re excited to introduce 史诗—our innovative solutions designed to simplify and empower your journey toward a greener future.

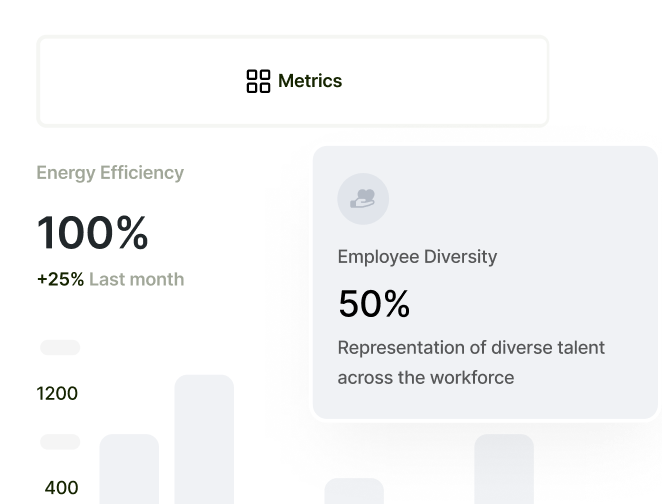

史诗 is our all-in-one ESG data management platform, making sustainability reporting seamless and straightforward. Its standout features are:

Want to learn more about how EPIC can help your business cut its carbon footprints and drive actionable sustainability? Get in touch with us today and discover how our innovative tools are paving the way for a sustainable future.

Regulatory reporting in 2025 is more than compliance—it’s a blueprint for transparency, trust, and transformation. As the convergence between ESG and regulatory requirements accelerates, organizations must evolve their strategies accordingly.

Whether disclosing carbon emissions, cybersecurity risks, or capital reserves, the organizations that invest in proactive, tech-enabled, and ESG-integrated reporting will lead the way in resilience, reputation, and results.

Start by evaluating your current regulatory reporting infrastructure. Consider how it aligns with ESG priorities, digital capabilities, and cross-border obligations. In a world shaped by transparency and stakeholder accountability, regulatory reporting is your foundation for responsible growth.

参考资料

[1] https://www.pwc.com/us/en/library/pulse-survey/executive-insights-election-2024/sectors.html

[3] https://www.pwc.com/gx/en/issues/c-suite-insights/global-investor-survey.html

监控投资组合中的ESG表现,创建自己的ESG框架,并做出更明智的商业决策。

请填写右侧表单或直接通过以下邮箱与我们联系

sales@senecaesg.com7 Straits View, Marina One East Tower, #05-01, Singapore 018936

+65 6223 8888

Gustav Mahlerplein 2 Amsterdam, Netherlands 1082 MA

(+31) 6 4817 3634

No. 299, Tongren Road, #2604B Jing'an District, Shanghai, China 200040

(+86) 021 6229 8732

77 Dunhua South Road, 7F Section 2, Da'an District Taipei City, Taiwan 106414

(+886) 02 2706 2108

Viet Tower 1, Thai Ha, Dong Da Hanoi, Vietnam 100000

(+84) 936 075 490

Av Jorge Basadre Grohmann 607 San Isidro, Lima, Peru 15073

(+51) 951 722 377