Interested? Contact us now

In order to contact us please fill the form on the right or directly email us at the address below

sales@senecaesg.com

The U.S. Securities and Exchange Commission (SEC) is set to reconsider long-standing rules requiring companies to include environmental, social, and governance (ESG) proposals in shareholder proxy materials. SEC Chair Paul Atkins announced the move during a keynote speech at the University of Delaware, signaling a potential shift in how the agency views the role of ESG issues in corporate governance [1][2].

Atkins said the planned Shareholder Proposal Modernization aims to “de-politicize shareholder meetings and return their focus to voting on director elections and significant corporate matters,” arguing that ESG-related proposals often “involve issues not material to the company’s business” and “consume a significant amount of management’s time” [1]. The initiative will involve a re-evaluation of Rule 14a-8, the 1942 regulation that gives shareholders the right to include proposals in company proxy statements.

The SEC chair questioned whether the original rationale for Rule 14a-8 “still applies today,” noting changes in shareholder communication and corporate governance over the past 80 years [1]. Atkins also suggested that under Delaware law where more than 60% of U.S. public companies are incorporated, firms could exclude ESG proposals that are “not a proper subject” for shareholder action, provided they obtain an opinion of counsel and the SEC concurs [1][2].

In his remarks, Atkins argued that ESG proposals “almost always receive even lower support than shareholder proposals do generally,” and that limiting them would reduce unnecessary costs for companies [2]. The proposal marks another step in a broader deregulatory trend at the SEC, reflecting growing federal pushback against ESG integration in corporate America. Recent moves, such as the agency’s retreat from mandatory climate disclosure requirements, have underscored this shift [2].

However, the move has sparked criticism from sustainable investment advocates. Ceres, an organization focused on responsible investing, called Atkins’ approach “deeply concerning,” warning that it “points to an abdication of the agency’s investor protection mandate” [1]. Ceres’ Director Andrew Collier emphasized that the shareholder proposal process “has been a cornerstone of investment stewardship and good governance for decades,” and urged the SEC to allow public input before making such a major policy change [1].

If implemented, the proposed reforms could significantly curtail investors’ ability to influence corporate practices through ESG-related shareholder proposals, potentially redefining the boundaries of shareholder engagement in U.S. capital markets.

References

[1] ESG Today. SEC Chief Asks Commission to Reconsider Rules Allowing Shareholder ESG Proposals. https://www.esgtoday.com/sec-chief-asks-commission-to-reconsider-rules-allowing-shareholder-esg-proposals/

[2] JD Supra. SEC to Discourage ESG Shareholder Proposals. https://www.jdsupra.com/legalnews/sec-to-discourage-esg-shareholder-1385441/

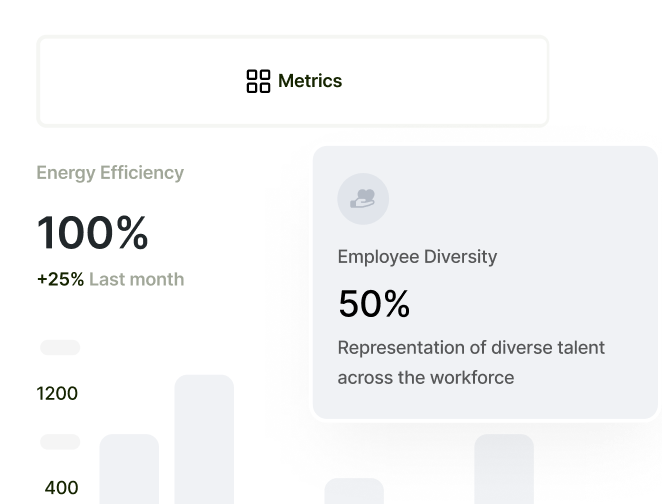

Monitor ESG performance in portfolios, create your own ESG frameworks, and make better informed business decisions.

In order to contact us please fill the form on the right or directly email us at the address below

sales@senecaesg.com7 Straits View, Marina One East Tower, #05-01, Singapore 018936

+(65) 6223 8888

Gustav Mahlerplein 2 Amsterdam, Netherlands 1082 MA

(+31) 6 4817 3634

77 Dunhua South Road, 7F Section 2, Da'an District Taipei City, Taiwan 106414

(+886) 02 2706 2108

Viet Tower 1, Thai Ha, Dong Da Hanoi, Vietnam 100000

(+84) 936 075 490

Av. Santo Toribio 143,

San Isidro, Lima, Peru, 15073

(+51) 951 722 377

1-4-20 Nishikicho, Tachikawa City, Tokyo 190-0022