Tertarik? Hubungi kami sekarang

Untuk menghubungi kami, silakan isi formulir di sebelah kanan atau email langsung ke alamat di bawah ini

sales@senecaesg.com

In April 2025, the European Commission introduced the “Omnibus Package,” a sweeping set of legislative amendments designed to simplify and harmonize existing EU sustainability regulations. The package modifies core frameworks such as the Corporate Sustainability Reporting Directive (CSRD), European Sustainability Reporting Standards (ESRS), EU Taxonomy, and the Corporate Sustainability Due Diligence Directive (CSDDD), aiming to reduce administrative burdens for businesses while preserving the EU’s climate and social objectives [1][3].

The reforms respond to growing concerns from companies and member states about overlapping obligations, inconsistent reporting requirements, and the high costs of compliance. However, the Omnibus has sparked debate: while the Commission emphasizes efficiency and competitiveness, some critics fear it could dilute the EU’s sustainability ambition [4].

The Omnibus Package follows extensive consultations with industry, regulators, and civil society. Its primary goals are to:

According to the Commission, these changes could cut compliance costs by up to 20% for some companies without undermining transparency [3]. This aligns with a broader EU competitiveness agenda, which seeks to encourage investment and innovation in sustainable technologies while avoiding excessive bureaucracy.

| Kerangka kerja | Pre-Omnibus Requirements | Omnibus Changes | Expected Impact |

| CSRD | Broad disclosure obligations covering environmental, social, and governance factors, applying to large and listed SMEs. | Reduced data points for certain sectors, phased implementation for SMEs, and alignment of terminology with ESRS. | Lower compliance costs; improved comparability across sectors. |

| ESRS | Detailed, sector-agnostic sustainability standards requiring extensive quantitative and qualitative data. | Streamlined metrics, fewer mandatory datapoints, and optional disclosures for immaterial topics. | Reduced reporting complexity, especially for SMEs. |

| Taksonomi Uni Eropa | Technical screening criteria defining “sustainable” economic activities, often criticized as overly complex. | Simplified criteria descriptions and harmonized reporting templates. | Easier classification of green activities; clearer investor communication. |

| CSDDD | Due diligence obligations covering human rights and environmental impacts in supply chains. | Extended transition periods, narrowed scope for smaller companies, and clarified definitions. | Greater feasibility for compliance; reduced litigation risk for SMEs. |

While the reforms aim to make sustainability regulation more practical, they raise important questions about ambition. For example, environmental groups have expressed concern that fewer mandatory disclosures could limit the depth of information available to stakeholders, potentially undermining the double materiality principle central to the CSRD [4].

From a corporate perspective, however, simplification could free up resources for substantive climate action, innovation, and ESG integration into business strategy. This echoes ongoing debates in other sustainability areas, such as whether focusing on avoided emissions (Scope 4) can meaningfully accelerate impact while keeping compliance manageable.

The Omnibus presents several strategic opportunities:

Despite the benefits, businesses must manage potential pitfalls:

To maximize benefits from the Omnibus while safeguarding ESG ambition, companies should:

The EU Omnibus marks a pivotal moment in the evolution of European sustainability regulation. By simplifying requirements, it aims to strike a balance between robust ESG disclosure and economic competitiveness. Businesses that proactively adapt can benefit from reduced compliance costs, improved stakeholder engagement, and stronger integration of sustainability into core strategy. However, they must remain vigilant to ensure simplification does not come at the expense of ambition or credibility.

Referensi:

[1] https://finance.ec.europa.eu/news/omnibus-package-2025-04-01_en

[2] https://kpmg.com/xx/en/our-insights/ifrg/2025/esrs-eu-omnibus.html

[3] https://ec.europa.eu/commission/presscorner/detail/en/ip_25_1843

[4] https://www.esgtoday.com/eu-member-states-agree-on-bigger-cuts-to-sustainability-reporting-due-diligence-than-omnibus-proposal/

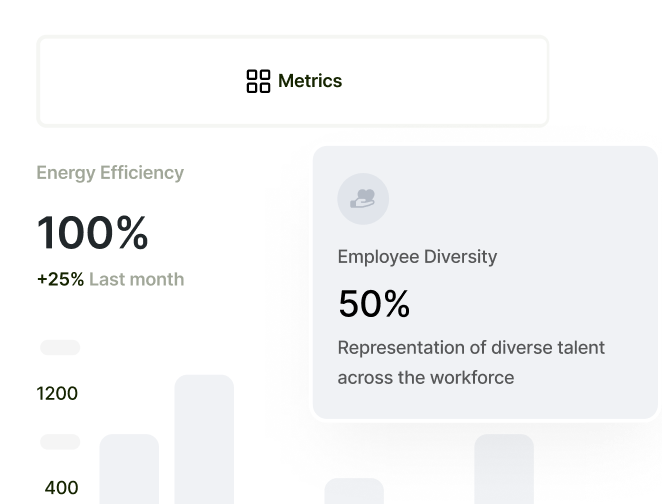

Pantau kinerja ESG di portofolio, buat kerangka ESG Anda sendiri, dan ambil keputusan bisnis yang lebih baik.

Untuk menghubungi kami, silakan isi formulir di sebelah kanan atau email langsung ke alamat di bawah ini

sales@senecaesg.com7 Straits View, Marina One East Tower, #05-01, Singapura 018936

+(65) 6223 8888

Gustav Mahlerplein 2 Amsterdam, Belanda 1082 MA

(+31) 6 4817 3634

77 Dunhua South Road, 7F Section 2, Distrik Da'an Taipei City, Taiwan 106414

(+886) 02 2706 2108

Viet Tower 1, Thai Ha, Dong Da Hanoi, Vietnam 100000

(+84) 936 075 490

Av. Santo Toribio 143,

San Isidro, Lima, Peru, 15073

(+51) 951 722 377

1-4-20 Nishikicho, Tachikawa City, Tokyo 190-0022