Intéressé ? Contactez-nous maintenant

Pour nous contacter, veuillez remplir le formulaire à droite ou nous envoyer directement un email à l'adresse ci-dessous

sales@senecaesg.com

In 2025, Environmental, Social, and Governance (ESG) performance has emerged as a decisive factor in shaping corporate value. As investors, regulators, and consumers increasingly evaluate companies through a sustainability lens, the question is no longer if ESG affects financial performance, but how. This article explores the correlation between ESG and financial performance, debunks myths, and outlines strategies to improve your ESG performance for long-term profitability.

According to PwC’s 2024 ESG Investor Survey, approximately 80% of institutional investors now consider ESG factors a critical component of investment decision-making [1]. Similarly, Bloomberg reports that global ESG assets are expected to surpass $50 trillion by 2025—representing one-third of total assets under management [2].

The relationship between ESG and financial performance has evolved from theoretical curiosity to empirical certainty. Numerous studies and real-world data confirm a compelling link: companies with strong ESG performance tend to outperform their peers over the long term. ESG isn’t just about values—it’s about value creation.

A meta-analysis by NYU Stern found that 58% of studies showed a positive relationship between ESG performance and financial returns, while only 8% demonstrated a negative association [3]. What’s driving this link? The answer lies in how ESG-aligned companies manage risk, capitalize on opportunity, and strengthen stakeholder trust.

ESG performance is thus a multidimensional advantage—mitigating downside risk while enhancing growth potential. The key is integration: ESG must be embedded into core operations, not treated as an add-on or public relations tool.

The relationship between ESG and financial performance has been extensively studied. Numerous meta-analyses confirm a positive correlation. A 2023 study by NYU Stern found that 58% of reviewed studies showed a positive relationship between ESG performance and financial returns, while only 8% found a negative link [3].

Understanding the tangible financial outcomes of ESG performance is critical for business leaders seeking to align purpose with profitability. The following data points highlight how strong ESG metrics translate into measurable advantages across key areas of corporate finance.

A 2024 MSCI analysis revealed that companies in the top ESG quintile (top 20%) outperformed those in the bottom quintile over the 2012–2023 period, highlighting a consistent link between strong ESG performance and superior long-term financial returns [4]. Strong ESG performance is often a proxy for sound management practices and long-term strategic thinking.

Firms with better ESG scores typically enjoy lower capital costs. A 2024 study published in MDPI analyzing S&P 500 companies found a negative linear relationship between ESG scores and cost of debt, with a correlation coefficient of -0.17—indicating that companies with higher ESG scores generally benefit from lower borrowing costs [5]. Lenders increasingly view ESG metrics as indicators of creditworthiness.

During the COVID-19 pandemic and subsequent supply chain crises, ESG-resilient companies demonstrated faster recovery times and more stable earnings. A global survey by WTW found that 77% of risk managers believe the risk function should play a more active role in ESG initiatives, highlighting the growing connection between ESG strategies and risk management [6].

Accenture report found that nearly half of global consumers are highly motivated to purchase environmentally friendly products, reflecting a growing preference for brands perceived as sustainable and socially responsible [7]. ESG performance now directly influences revenue generation.

The financial impact of ESG varies across industries, shaped by each sector’s exposure to environmental risks, stakeholder expectations, and operational dependencies. Understanding this variation helps companies implement more effective, targeted ESG strategies that align sustainability efforts with business performance.

| Secteur |

ESG Relevance & Impact on Financial Performance |

| L'énergie | Transitioning from fossil fuels to renewables reduces regulatory and carbon pricing risks while unlocking subsidies. Ørsted and NextEra Energy are examples of high-performing ESG leaders in this space. |

| Services financiers | ESG-integrated lending and investment strategies improve long-term risk profiles and attract sustainable finance investors. Firms like HSBC and Goldman Sachs lead in ESG-linked financing. |

| Technologie | Focus on data ethics, AI governance, and cybersecurity strengthens stakeholder trust and reduces reputational risk. Microsoft and Salesforce publish transparent ESG scorecards. |

| Consumer Goods | Ethical sourcing and sustainable packaging enhance brand loyalty and influence buying behavior. Unilever and Patagonia demonstrate ESG-led revenue growth. |

| Fabrication | ESG practices like energy efficiency, emissions reduction, and resource circularity help meet regulations and drive cost savings. Siemens and Schneider Electric benefit from strong supplier demand and resilience. |

Sector-specific ESG adoption shapes everything from investment appeal and customer loyalty to regulatory risk and operating margin. Companies should benchmark against sector leaders and tailor ESG initiatives accordingly to optimize ROI and long-term resilience.

The ESG-financial performance relationship varies across sectors. Understanding this variation is key to strategic planning:

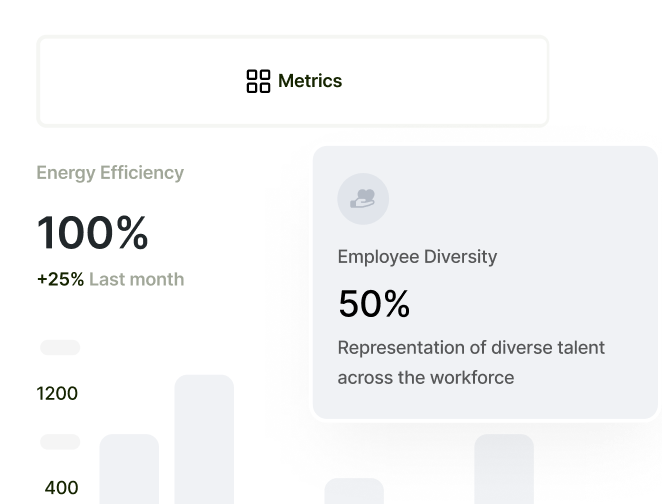

Improving ESG performance requires a structured, integrated approach that starts with setting measurable goals. Companies should define key ESG performance indicators (KPIs) aligned with global standards such as GRI, SASBet ISSB. Metrics like greenhouse gas emissions, board diversity, employee engagement, and supplier responsibility provide a solid foundation for progress.

Beyond goal setting, ESG must be embedded into corporate strategy—not treated as a standalone function. This involves cross-functional collaboration across finance, HR, procurement, and operations to ensure ESG is considered in budgeting, planning, and performance evaluations. When ESG becomes part of day-to-day operations, companies build stronger accountability and resilience.

Divulgation is also critical. Transparent ESG reporting, verified by third parties and aligned with regulatory frameworks like the EU’s CSRD or U.S. SEC guidelines, builds investor confidence and stakeholder trust. Leveraging digital tools—like Seneca ESG’s AERA platform or Workiva’s ESG solution—can streamline compliance, automate data tracking, and generate actionable insights.

Lastly, engaging stakeholders is key to success. Organizations should regularly consult employees, investors, suppliers, and community partners to shape ESG priorities. Tools like materiality assessments and engagement surveys help ensure ESG initiatives are both relevant and impactful.

Unilever: Unilever has long championed ESG initiatives. Its Sustainable Living Brands grew 69% faster than the rest of the business and delivered 75% of overall growth [8]. The company’s ESG leadership has also made it a preferred stock for ESG-focused funds.

BlackRock: BlackRock integrates ESG analysis into all active portfolios. It reports that ESG-integrated portfolios have matched or exceeded benchmark performance with lower volatility, reinforcing the financial value of sustainability [9].

Patagonia: Though privately held, Patagonia exemplifies ESG’s financial logic. Its commitment to environmental stewardship has driven customer loyalty and brand equity, turning purpose into profit [10].

The evidence is clear: ESG performance has a significant impact on financial performance. From reduced risks and lower capital costs to increased revenue and brand equity, ESG is not just about ethics—it’s about economics.

Companies that proactively improve their ESG performance will enjoy strategic advantages in a market that rewards resilience, transparency, and forward-thinking leadership.

Now is the time to act. Conduct an ESG audit, align with global standards, invest in technology, and communicate transparently with stakeholders. The relationship between ESG and financial performance is no longer theoretical—it’s a defining factor of business success in 2025 and beyond.

Références :

[1] https://www.pwc.com/lt/en/about/press-room/pwc-global-investor-esg-survey.html

[2] https://sponsored.bloomberg.com/article/mubadala/the-future-of-esg-Investing

[4] https://www.msci.com/www/research-report/msci-esg-ratings-in-global/04434884917

[5] https://www.mdpi.com/1911-8074/17/3/91

[6] https://www.wtwco.com/en-th/insights/2022/10/2022-esg-global-risk-managers-survey

[8] https://www.unilever.co.za/news/press-releases/2019/unilevers-purpose-led-brands-outperform/

[10] https://www.ewadirect.com/proceedings/aemps/article/view/3750

Suivez les performances ESG dans les portefeuilles, créez vos propres cadres ESG et prenez de meilleures décisions commerciales éclairées.

Pour nous contacter, veuillez remplir le formulaire à droite ou nous envoyer directement un email à l'adresse ci-dessous

sales@senecaesg.com7 Straits View, Marina One East Tower, #05-01, Singapour 018936

+(65) 6223 8888

Carrer de la Tapineria, 10

Ciutat Vella, 08002, Barcelona, Spain

+34 612 22 79 06

77 Dunhua South Road, 7F Section 2, Da'an District Taipei City, Taïwan 106414

(+886) 02 2706 2108

Av Jorge Basadre Grohmann 607 San Isidro, Lima, Pérou 15073

(+51) 951 722 377